By Melinda Beck WSJ 12/26/2014

Updated Dec. 25, 2014 2:59 p.m. ET

Internist Douglas Olson has seen firsthand the impact—and the side effects—of the Affordable Care Act’s first year of expanded health-care coverage.

One patient at his clinic had lost her previous insurance after being diagnosed with lung cancer. This year, she was able to find an affordable policy that covered her treatments and follow-up scans.

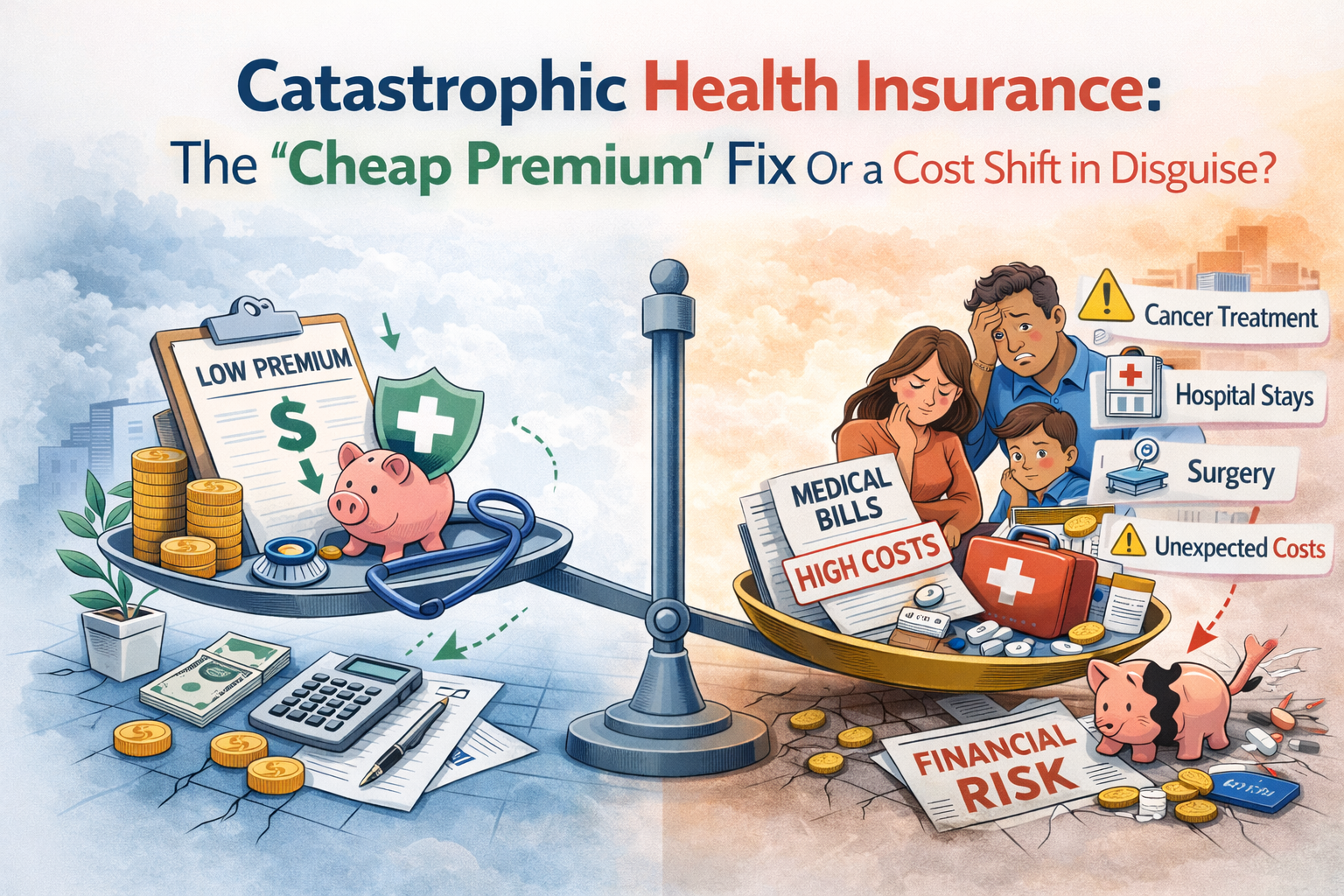

Another woman needed an MRI for her chronic shoulder pain, but had to pay the $1,000 tab out-of-pocket, because she hadn’t satisfied her new plan’s deductible. She decided her $50 monthly premiums weren’t getting her much value and is giving up her coverage until she qualifies for Medicare in two years.

“You and I know that’s how insurance works—you pay a little bit now and if you get really sick, it pays for itself,” said Dr. Olson, 39 years old, chief medical officer of the Norwalk Community Health Center in Connecticut. “But for someone who’s never had insurance before, it’s easy to think, ‘What am I paying these premiums for?’ ”

Dr. Olson’s patients illustrate the trade-offs and lessons in the sweeping federal health law.

Overall, 6.7 million Americans have obtained and paid for private coverage on the insurance marketplaces for this year, according to federal officials. Almost 10 million more qualified for Medicaid due to provisions in the law. And the percentage of uninsured dropped from 17.7% to an estimated 12.4%, according to the Urban Institute.

In the second yearly enrollment, almost 6.4 million people selected a health-care plan on the federal marketplace or were automatically re-enrolled between Nov. 15 and Dec. 19, Health and Human Services Secretary Sylvia Mathews Burwell said Tuesday. The figures include about 1.9 million new consumers but don’t include enrollees from state-run exchanges. Enrollment on the federal exchange runs through Feb. 15.

How the Affordable Care Act has helped—and what it has cost—consumers, employers and care providers varies enormously. Some people with life-threatening illnesses found coverage. Some hospitals and doctors are seeing more patients with the ability to pay. But many families and businesses are facing higher costs. There is still confusion over how the new plans work and a palpable disconnect between near-term expenses and long-term public-health goals.

The public remains deeply divided. As of last month, more Americans viewed the law unfavorably (46%) than favorably (37%)—a shift from four years earlier, when respondents favored it 42% to 40%, according to a Kaiser Family Foundation poll.

“The fundamental impetus for the law was to lower the number of uninsured, and it has clearly done that,” said Larry Levitt, a senior vice president at the Kaiser Family Foundation. “But simply getting people insured doesn’t mean health care is affordable.”

A Wall Street Journal project following 10 stories of people affected by the health law over the year shows the wide range of experiences.

The community health center where Dr. Olson works provides low-cost primary care. Many patients who signed up for coverage “have had tremendously positive experiences—they actually consider it a privilege to be insured, because they could never afford it before,” said Dr. Olson.

But others were frustrated that they had to pay premiums and pay for much of their care out-of-pocket because they chose cheaper plans with high deductibles.

Nationwide, the median deductible for individuals was $5,100 in bronze plans and $2,500 in silver plans, according to a McKinsey & Co. analysis.

To be sure, insured patients can get preventive care, including vaccinations and screenings for cancer, without any deductibles or copays under the law. But that has been a hard sell for some patients.

“Prevention, starting now, doesn’t pay off for a number of years,” said Dr. Olson.

All in all, Dr. Olson said he and his colleagues think even harder whether costly tests and procedures are necessary than they did before the ACA. “If you’d asked me a year ago, I wouldn’t have predicted that,” he said.

Some economists say the impact of high-deductible plans, prominent in employer-sponsored coverage as well, was a key driver in holding the growth of health-care costs to 3.6% in 2013—the lowest since the government started measuring it in 1960. At $2.9 trillion last year, the share of the nation’s gross domestic product devoted to health care remained 17.4%, unchanged since 2009.

Government actuaries expect to see a spurt in national health spending—rising by 5.6% in 2014, due to the ACA’s coverage expansion, and reaching 19.3% of GDP by 2023.

Some hospitals have already seen windfalls, with more paying patients boosting revenues. HCA Holdings Inc. —the largest hospital chain by revenue—reported a 41.9% increase in net income on revenue of $9.2 billion for the third quarter, compared with a year earlier.

But systems like Truman Medical Centers in Kansas City, Mo., one of the mostly Republican-leaning states that declined to participate in the law’s Medicaid expansion, face challenges. Truman cares for many uninsured patients and is desperate for Missouri to expand Medicaid. CEO Charlie Shields is also bracing for bigger financial problems in 2017, when federal payments that help provide that uncompensated care are set for cuts.

The impact on insurers has also been mixed. For actuary Mike Beuoy and his employer, Blue Shield of California, offering plans on the state’s marketplace turned out to be a good bet. The nonprofit made money because more people signed up than expected, and they were healthier than it projected when it set 2014 rates.

Several big companies warned they will post losses on their individual business. But for now, the industry seems willing to double down on the exchanges, with some companies, including giant UnitedHealth Group Inc., boosting their presence next year.