Strategic Insurance Solutions to Protect Your Life, Business & Legacy

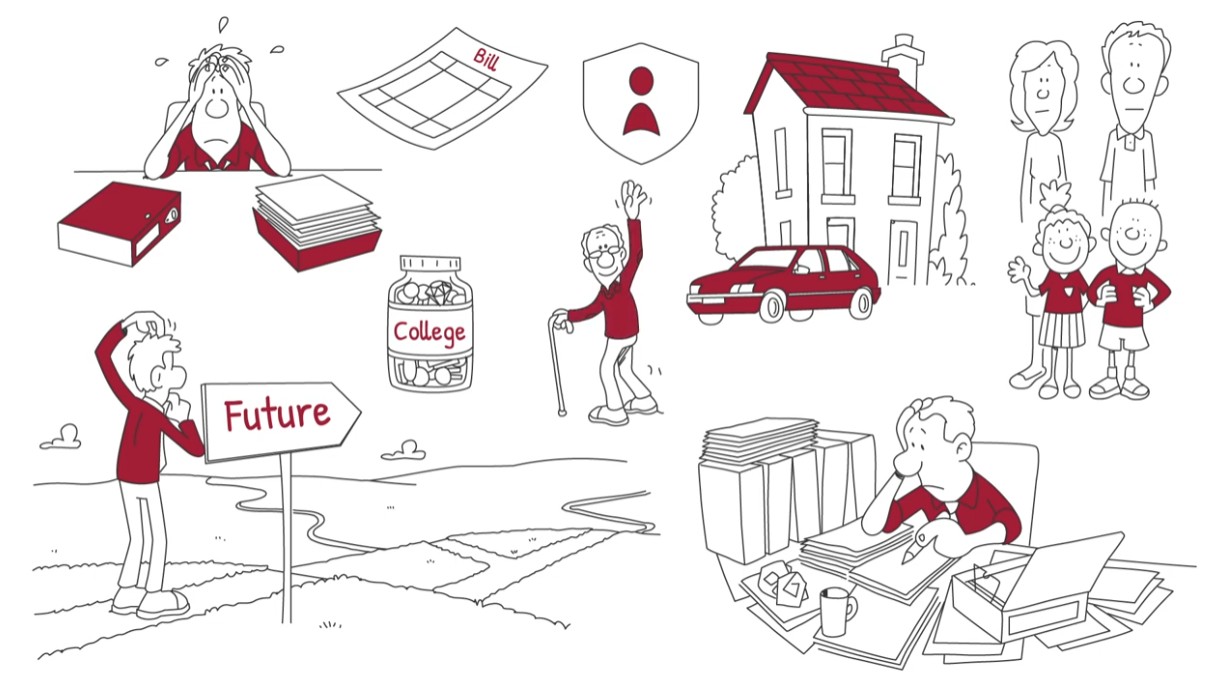

We help professionals and business owners build smart, forward-thinking insurance strategies that prevent disruptions and protect what matters.

Many talk insurance, we know how to make it truly perform.

The Life Insurance Audit™

You bought life insurance to protect everything that matters.

But is it still doing its job?

Over time, many policies become outdated, overpriced, or ineffective. The Life Insurance Audit™ reviews your current plan to show how it’s performing, where it falls short, and what smarter options may be available.

Find out why over 50% of policies we review aren’t the best possible fit.

We help you protect your wealth, legacy, and family with confidence.

The Life Insurance Audit™

Life Insurance

Your Life Insurance Portfolio:

Maximize Protection, Build Real Value

Life Insurance

Life insurance isn’t just a policy; it’s a powerful financial strategy.

At CorpStrat, we help you build a smart portfolio that blends term and permanent coverage to meet both short- and long-term goals.

Whether it’s for retirement, liquidity, or estate planning, we’ll help you maximize the value of every premium dollar so your plan grows with you.

This is how we simplify the complex.

This is how we think differently.

This is how we help you protect what matters most.

Disability Insurance

Disability Insurance

The RICH Uncle That Promises to Pay Your Bills if “Something Happens”

If you lost your paycheck tomorrow, how long could your family or business stay afloat?

Disability insurance protects your income by stepping in when you can’t work. It’s often overlooked—but it’s one of the most critical tools for business owners and professionals.

1 in 4 workers will experience a disability during their career.

We make sure your income won’t disappear if life throws you off course.

At CorpStrat, we simplify the complex and help you plan with clarity, so if something happens, your income doesn’t disappear.

Cause

Death

Disability

Cause

Hypertension

Death

Down 73%

Disability

Up 70%

Cause

Heart Disease

Death

Down 28%

Disability

Up 44%

Cause

Cardiovascular

Death

Down 48%

Disability

Up 36%

Cause

Diabetes

Death

Down 27%

Disability

Up 36%

Cause

All Four

Death

Down 32%

Disability

Up 55%

1 4

in

1 in 4 of today’s 20-year-olds will become disabled before retirement age

30%

Approximately 30% of individuals aged 35 to 65 will experience a disability lasting at least 90 days during their careers.

2.5

The average duration of a long-term disability claim is about 2.5 years.

35%

Only about 35% of the private-sector workforce has any long-term disability insurance.

Long-Term Care Insurance

The Self-Insured Risk Most People Never Plan For

A long-term care event could cost $10,000+ per month.

Most people haven’t planned for it, and Medicare doesn’t cover it.

Our Perfect LTC Solution™ is a hybrid policy that protects your assets, provides care benefits if needed, and leaves a legacy if not.

The Perfect LTC Solution

It’s NOT an expense, It’s an asset.

-

Everything

guaranteed

-

Robust LTC

benefits for single or couples

-

Builds equity /

Cash out if you quit

- Death Benefit if LTC not used

The Smarter Way to Prepare for the Unpredictable

At CorpStrat, we simplify the complex and help you think differently about risk.

The Perfect LTC Solution™ is part of our strategic approach to protecting your future while staying flexible, efficient, and in control.

Long-Term Care Insurance

Business Continuation Planning

Business Continuation Planning

Protect the Business You Built. Secure the Future They Depend On.

If something happened to you, would your business survive or be forced to sell at a loss?

We help business owners prepare for the unexpected with strategic insurance tools like key person, buy-sell, and succession planning. It’s not just financial, it’s foundational.