Insurance Solutions

We work closely with professionals and business owners to identify areas of danger, the disrupters of success and help assure a plan and path for the unexpected and unplanned. Many professionals “talk” insurance – few know how to make it “really” perform.

THE LIFE INSURANCE AUDIT™

Is Your Life Insurance Working For you?

Imagine that you own an extremely complex planning instrument, and had no tools to measure its effectiveness, determine it is working properly, or benchmark the performance against other opportunities in a rapidly changing financial services economy.

Further, imagine that the instrument is so valuable that your family may have to depend upon it to live, educate, pay your debts, complete your business obligations, and create a legacy upon your premature death. That product is life insurance, and when left unmanaged, can lead to disastrous planning.

We have taken years of experience and developed a process called The Life Insurance Audit™. The Life Insurance Audit™ is a proven, objective system, which ensures clients have the best possible insurance solution available in the market today.

The Life Insurance Audit™ is a process that helps professionals analyze and measure the effectiveness of their life insurance plans, evaluate current and future projections of performance, determine if a current assessment of the clients health can help to improve their position, or, validate a purchase made as ‘sound’.

LIFE INSURANCE

Building a Life Insurance portfolio

We believe an insurance portfolio is as important as an investment portfolio. We advocate not merely layering insurance policies over time, but implementing a systematic program that marries a strategy between your needs and achieving your financial independence.

Some questions to consider when you think about life insurance:

- How long will you need the coverage?

- How much coverage is appropriate?

- What is the insurance to accomplish?

- What types of coverage (term or permanent) are right for you?

- Can you use the built up cash values for retirement and other goals?

We are committed to maximizing the power of your premium dollars. Our clients’ portfolios will often include a blend of term insurance to cover specific short-term needs and permanent contracts such as Universal Life, Variable Life and Whole Life for longer-term goals and wealth accumulation.

Life insurance can be used for risk management as well as building wealth – an additional asset in your investment portfolio.

DISABILITY INSURANCE

The RICH Uncle That Promises to Pay Your Bills if “Something Happens”

If you have financial obligations – rents, overhead, salaries, mortgage, car payments, colleges, retirement accumulation goals, etc…. sickness or injury can disrupt a lifetimes of savings. Imagine the impact of the loss of your income that comes with any sort of illness: or the loss of a key employee on your business.

Most of us don’t have that “rich Uncle” who would step in and pay your bills if you became ill or were unable to work.

Disability insurance provides an absolute guarantee of income, and commences at exactly the right times to assure that should your paycheck end, a paycheck continues. Disability is the leading cause of foreclosures in the USA. Yet few professionals have adequately planned for such an event.

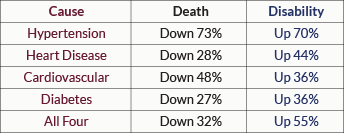

As the following chart illustrates, deaths have decreased while disabilities are up dramatically.

Nobody wants to think about it, but you must take steps to protect your family and your future from what might happen if you become disabled and could not work.

LONG-TERM CARE INSURANCE

The Self – Insured risk

Imagine the impact of requiring assistance to do daily tasks – walking, dressing, bathing, eating, toileting, etc, as a result of a chronic or disabling illness. Where would your family go to pay a $5,000 to $7,000 expense? How long would your assets last? Would you have enough for your family?

The largest planning void in the USA is the failure to address the financial impact of any extended illness – age related or not – which is largely unfunded. Traditional health insurance and Medicare do NOT cover this exposure. How do you prepare for such a expense and exposure? It’s the largest “self-insured” most of us have!

Unlike traditional health insurance LTC is designed to cover long-term services and support, including personal and custodial care in a variety of settings such as your home, a community organization, or other facility.

Review and evaluate how a properly designed Long Term Care policy can help you assure this exposure.

BUSINESS CONTINUATION PLANNING ISSUES

What Is the Real Value of Your Business to You and Your Family?

Have you ever considered the impact your death or disability could have on the value of your business, and the stream of income upon which you and your business and family depend?

If you’re like most business owners, ownership of a business has provided you with the opportunity to build an asset of considerable value…an asset that also generates a stream of income upon which your lifestyle and that of your family is dependent.

Planning Considerations

Consider…

- If you had died or become disabled yesterday, who would own and operate your business today?

- Would your business be able to continue an income to you if you became disabled?

- Would your business be in a position to continue an income to your family in the event of your death?

- Would your estate have sufficient liquid assets to pay estate taxes and other estate settlement costs?

Without Advance Planning, the Facts Are…

- A small business may be forced to liquidate at an owner’s death or disability; or

- The business may have to be sold, often at a greatly diminished value.

The objective of business continuation planning is to assist you in evaluating which of these alternatives is most suitable for your situation and to help provide the funds that will be needed to assure that your business continuation goals become a reality. The team at Corporate Strategies can facilitate a discussion and establish a plan of action.

LINKED BENEFITS LIFE/LTC

Protect yourself. Preserve your legacy.

A Linked Benefits policy is a unique life insurance product that allows you to protect your assets from a potential long term care (LTC) event and leave a legacy to your loved ones without having to purchase two separate policies. By paying either an initial lump sum premium, or an ongoing annual outlay, you immediately create a death benefit for your beneficiaries and a pool of money to pay for covered long term care needs. This approach is ideal for many:

You are a Saver.

You plan to use your savings to pay for a long term care event if needed. (so you are basically self – insured)

You care for your family. You may have assets but want to assure a legacy.

You would love to leave a legacy to your beneficiaries. Tax free. But you want to assure your lifestyle.

You are a prudent Investor – You want to deploy your assets to maximize their potential. You also want to make sure you are prepared for a long term care event and still have money available for growth opportunities or to spend however you want.

You are unsure about the future of traditional long term care. You understand the importance of long term care insurance but are hesitant to buy a product you may never need. and one where premiums may be uncertain.

Consider how a HYBRID type of Life and LTC policy can help you assure and provide for many needs.

ANNUITIES

What is an annuity?

For years, if Americans wanted opportunity, they would put their savings in the stock market. If they wanted safety, they used bank CDs or government bonds. The problem was you could have money positioned for opportunity or safety, but not both on the same dollar at the same time.

Today, investors are finding how to have both safety and opportunity with the same dollar at the same time. The vehicle that has filled the gap between the stock market and banks is called an Annuity – one of the most powerful tax-favored financial planning instruments.

But,annuities are perhaps the most complex financial instruments in the entire financial services industry. There are literally hundreds of different companies and products and designs. How do you determine what is right, and how to you know if your current annuity is performing to standard?