Empowering Businesses. Enhancing Confidence

A Team That

Thinks Differently

At CorpStrat, culture means more than words on a wall; it’s about delivering clarity, professionalism, and protection in every interaction.

When you work with us, you get more than just benefits or insurance guidance. You get a trusted expert who knows your name, understands your goals, and is deeply committed to simplifying the complex so you can focus on what matters most.

Whether we’re helping you navigate compliance, optimize a benefits plan, or protect your income and legacy, you’ll feel the difference: clear communication, thoughtful strategy, and a genuine team behind you every step of the way.

Our Team

Protects What Matters Most

Where Strategy Happens

Our office reflects how we work: focused, collaborative, and built around relationships.

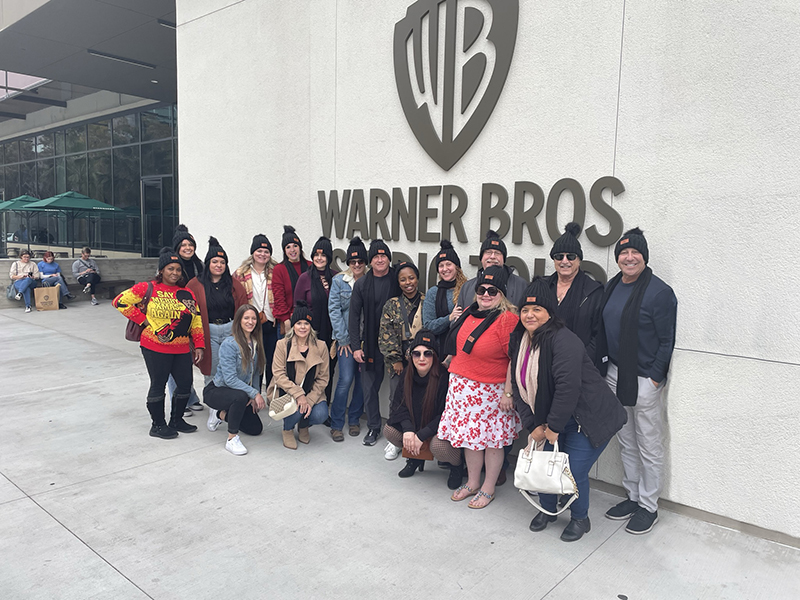

We Work Hard. We Show Up. And Yes, We Have Fun.

At CorpStrat, we take our work seriously, but we know a strong culture also comes from connection, laughter, and celebrating the wins together.

When people enjoy where they work, they show up stronger, for each other and for our clients.

What We Believe

At CorpStrat, our values aren’t just words on a wall, they guide how we work, how we communicate, and how we serve. Every decision, every client interaction, every solution reflects these core beliefs:

Clarity First

We believe communication should be clear, direct, and human. Our job is to simplify the complex so you always know where things stand.

Think Differently

We challenge outdated industry norms and bring fresh thinking to old problems. Innovation isn’t a buzzword, it’s how we serve better.

Protect What Matters

Whether it’s a family legacy or a fast-growing business, we treat your protection like our own with care, precision, and strategy.

Relentless Responsiveness

We respond quickly, follow through, and never leave clients guessing. You’ll never feel like a number with us.

Human First, Always

We lead with empathy. Our team shows up with honesty, integrity, and a true desire to do the right thing every time.

Ready To Get the Clarity and Confidence You Deserve?

Don’t leave your employee benefits and insurance strategies to chance.

Work with experts who make the complex simple and provide solutions you can trust.