It’s hard to believe that just a few short months ago, our country’s unemployment rate was at an all time low. Pre-pandemic, keeping employees happy often involved pricey company perks like free gourmet lunches, massages, and elite gym memberships. Now because of COVID-19, our entire world has changed: unemployment is soaring and non-essential teams have gone remote (and may remain remote). The entire US workforce and workplace has dramatically changed, which means what we offer our employees in terms of benefits has to undergo a dramatic change as well. Today we’ll go over creative solutions to help shift your benefits package to suit the new economic environment.

The Danger

For employers, it’s absolutely vital to alter your current benefits package in order to adapt to the current economic climate. Choosing not to do so could leave your company in the dust. In the coming months, as companies begin cautiously opening up offices and rehiring, they’ll face the challenge of potential employees viewing these slimmed down benefit packages as weak. It’s important to strike the right balance of not overspending in this new normal, while maintaining an attractive benefits package. We’ve also found that many employers cut spending in the wrong places because they aren’t aware of important tax opportunities and fail to take advantage of them.

How to Avoid

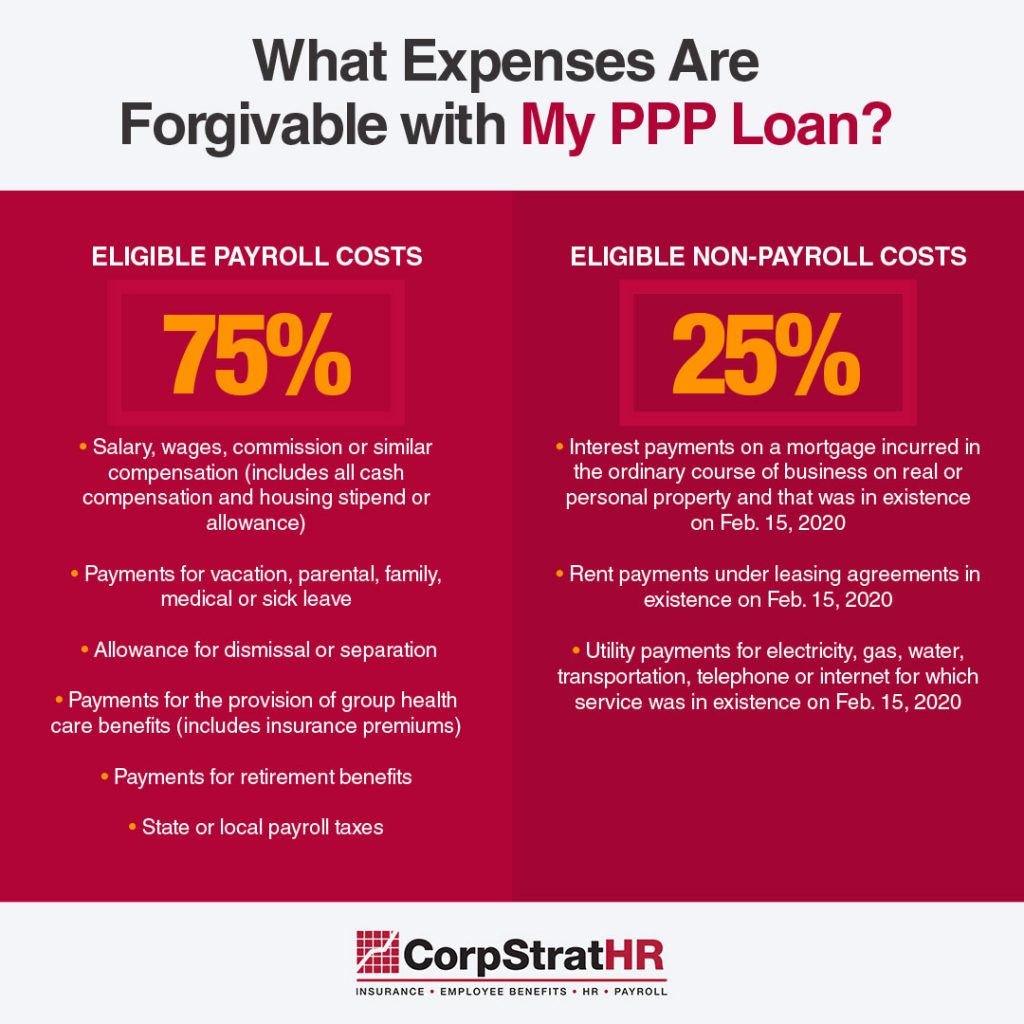

A lot of employers have been spending over 80% of the employees’ health insurance premiums on expensive plans. You can still offer full health coverage but switching down to silver plans in lieu of gold can cut costs by as much as 20%. Health insurance is a big line item on most employer’s profit and losses statements. It’s typically in the top three, right behind rent and salaries. Being able to change employer contributions and trim 20% out of employer costs is a huge opportunity right now.

At the same time inexpensive benefit plans can be added with minimal to no cost. Employees value plans like dental, vision, life insurance, and employer sponsored disability insurance. Plans that feature these can help employers round out their offerings without being a high cost item.

At the end of the day, don’t sell your benefits package short. Sometimes offering an appealing benefits package is all about how it’s presented. Creating a benefits brochure that points out both the obvious and hidden benefits offered can help current and potential employees understand the full scope of their benefits package.

There is also another great tool called a hidden paycheck. What a hidden paycheck statement does is give the employee an overview of all the money that the employer is spending on them—like taxes, health insurance, retirement plans, and other fringe benefits. For example, if an employee makes $60,000 a year, there’s a good probability they are only pocketing $3,500 a month. On this employee’s hidden paycheck statement, they would see everything the employer is spending on them, often totaling up to as much as $80,000 a year. Employees can then gain a greater sense of their value to the company rather than looking at their $3,500 take home pay.

Opportunity

The opportunity here is to modify plans and contributions based on the current economic environment. Get creative in building your benefit package, use voluntary plans, use ancillary plans, and lastly, shift employee perks to support work from home needs.

You’ll find that many of the traditional perks like company lunches, free snacks in the office, or commuter stipends, are no longer useful, and won’t be viewed favorably. Shifting perks to include things like virtual fitness memberships, mental health and telemedicine, wellness checks, childcare options, are what employees will value going forward.

Finally and maybe most importantly is adding a work from home policy in your benefits package. Many teams have gone remote without a noticeable drop in productivity. This means employees both know it’s possible to work efficiently from home and want to continue working from home. Including a work from home policy in the benefit package is going to be vital for most employers going forward to continue to attract top talent.

Tip

As we mentioned at the beginning, this is not a one size fits all. There’s no cookie cutter or plug and play approach, every industry and every situation is going to be unique. It’s important for employers to work with someone who can bring fresh ideas, understand the market, understand the industry and can bring real solutions.

–

See how CorpStrat can help you transform your Employee Benefits Package. Contact us at marketing@www.corpstrat.com.