In today’s digital business environment, your most valuable asset isn’t your inventory or even your people — it’s your data. From employee records to health insurance details, payroll figures to tax returns, the information your business handles is not only critical to your operations — it’s also a prime target for cyber threats and regulatory scrutiny.

As an employer, you are a data steward — and the responsibility to protect that data rests squarely on your shoulders.

What’s at risk?

- Employee health plan details (PHI)

- Payroll and compensation data

- Social Security numbers

- Financials, tax returns, and accounting records

- HR files, onboarding docs, and termination info

This is confidential, sensitive, and regulated information — and in many cases, sharing it with vendors opens you up to liability unless proper safeguards are in place.

What is a Business Associate Agreement (BAA)?

A BAA is a legal document required under HIPAA when a Covered Entity (like your company) shares Protected Health Information (PHI) with a third party (called a Business Associate).

It outlines:

- How that vendor can use your data

- Security measures they must have

- What happens in case of a breach

If your vendor handles PHI and you don’t have a BAA in place, your business could be liable for any mishandling, data breach, or HIPAA violation — even if it wasn’t your fault.

Who Needs to Sign a BAA With You?

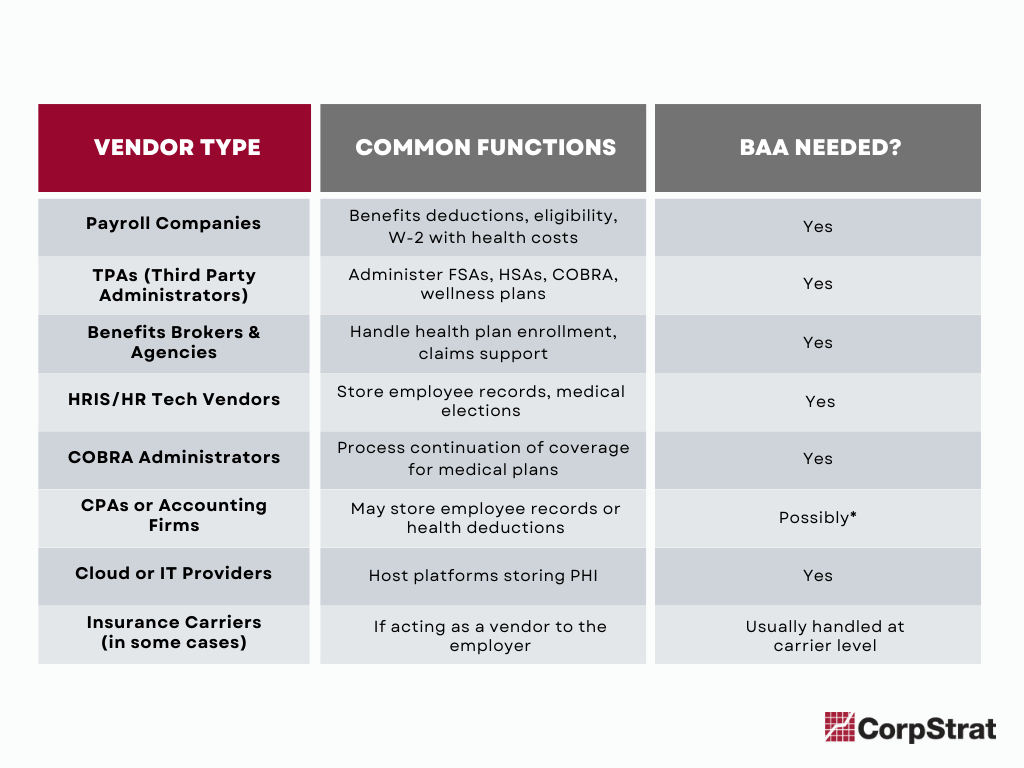

Here’s a rule of thumb: If they touch your employees’ health or personal data — get a BAA. Start with the below common vendors.

Vendors That May Require a BAA:

*CPA firms may not require a BAA unless they are directly handling PHI or managing plan-related details.

What You Should Be Doing as a Business Owner or HR Leader

- Audit Your Vendor List

Identify every third party with access to employee data or systems storing it. - Request a BAA From Each Vendor

Ask them: “Do you handle PHI or any health plan data? Do you have a BAA template or will you sign ours?” - Review Your Privacy Practices

- Are you encrypting emails with sensitive data?

- Who on your team has access to employee health records?

- How are files stored and backed up?

- Use Secure Channels

Avoid sending PHI or personal data through unencrypted email or shared drives without permission controls. - Train Your Staff

Make sure your HR and benefits team knows what qualifies as sensitive information and how to protect it.

Final Thought: Protect Data Like It’s Money — Because It Is

Data breaches, regulatory fines, and lost trust can cost your business far more than just a headache. Think of your data as digital currency — and make sure you’re working with partners who take that as seriously as you do.